Reading Time: < 5 min

I wanted to rework an old piece of content of mine that is related to an evergreen article by Paul Graham. But then the SVB failure happened and as it might shape a lot of decision-making in the near future, I would like to quickly go through it because it is also a good chance to review how the macro-economic situation impacts the behavior of highly skilled managers.

So, what is this SVB everybody is talking about?

What a crazy end of the week we experienced last week. Wow. The Silicon Valley Bank (SVB) failed in a 48-hour implosion which created extreme fear within startups and ventures capital circles. Its failure marks the second-largest bank failure in US history and the biggest one since Lehman Brothers in 2008.

All-In Podcast E119: Silicon Valley Bank implodes: startup extinction event, contagion risk, culpability, and more

SVB largely serves tech startups (about 44% of all US VC-backed startups) and held $212B worth of assets. It financed mostly companies before other financing institutions consider a company (literally) credible.

The collapse in a short timeline

The events can be summarized in an oversimplified turn of events as follows:

SVB gets lots of cash deposits over the past two years from startups and VCs

They use that money to buy dumb, underperforming securities like mortgages and 10-year T-Bonds (with a 1.75% interest)

Some stock sales happen in February 2023 from the CEO, CFO, CMO, and General Counsel that, in retrospect, could be “problematic”

SVB’s customers start pulling out cash faster than SVB can handle which gets so bad that SVB ends up being technically insolvent

People begin to notice SVB’s struggles from a SeekingAlpha post on December 19 and a newsletter post from Byrne Hobart on February 23, 2023

Pretty much every VC starts to pay very, very close attention to SVB earnings

On March 8th, SVB has to raise capital to help resolve the insolvency issue. It communicates why this is happening – poorly.

Peter Thiel, USV, and Coatue send out messages to portfolio companies to pull out funds

Tech Twitter catches word of this and mass hysteria spreads through group chats

A bank run happens on Thursday, March 9

SVB collapses and is taken over by the FDIC on Friday, March 10

Sunday, March 12, the Federal Reserve guarantees depositors, meaning people who banked there will be made whole

Why did things go south and they had to sell assets with a loss of $2B?

The simple answer is that they speculated in the treasury/bond market but since the interest rate hikes by the FED, the result turned out to be worse and worse over time.

The more complex answer: The client list (VC-backed startups) was a blessing when interest rates were low so startups were swimming in cash from VCs. Its deposits tripled between 2018 and 2021 while its balance sheet grew by 250% (s. graphic below)!

Found on Twitter: @carlquintanilla on March 12, 2023

But rising interest rates from the U.S. Federal Reserve made it increasingly difficult for startups to access similarly large sums of money as they did in 2021, and many had to fall back on deposits they had previously parked with the SVB.

The problem: In order to create the necessary liquidity for this demand for money, SVB had to sell securities that had drastically lost value due to the interest rates that had risen in the meantime. CEO Greg Becker was forced to announce a capital increase of around $2.5B to close the hole in the balance sheet.

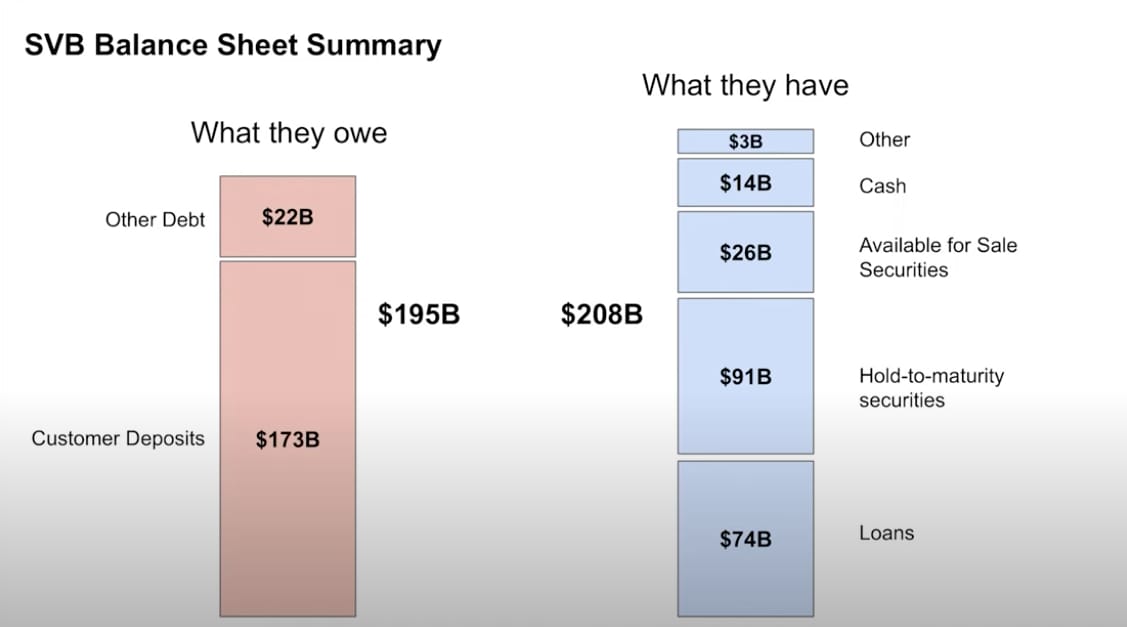

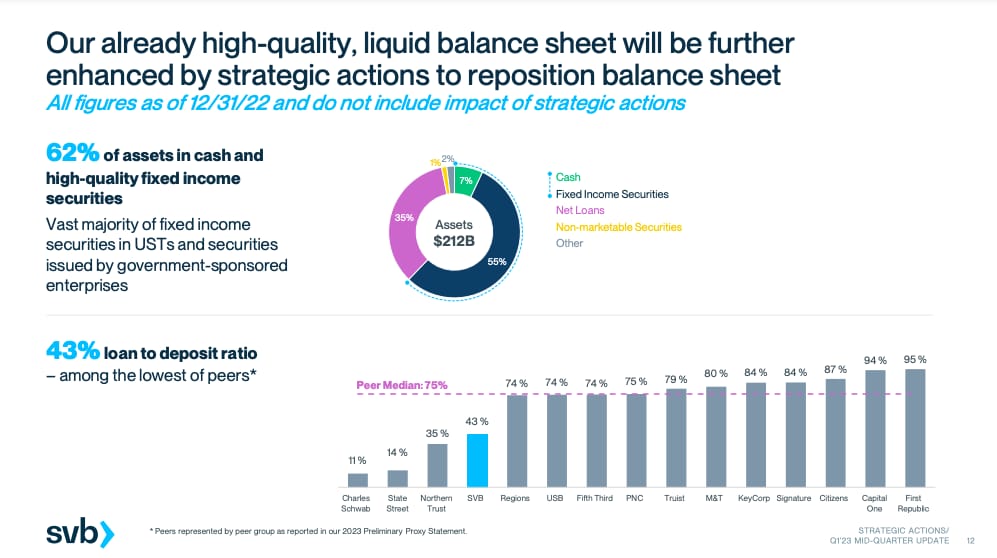

Now, people checked the numbers in detail and realized that SVB had 55% of its customer deposits invested in long-term bonds which decreased in value on a big scale due to the rate hikes by the FED (s. below the slide from Q1 2023 mid-quarter update).

Confidence in deposits was gone, and so the bank run started. To be exact, customers requested withdrawals of $42 B in a single day - a quarter of the bank's total deposits. Of course, SVB was unable to meet these requests.

Is it also impacting Europe?

Short answer: Yes. Since 2018, the financial institution has also been present in Germany and is one of the few local banks to provide debt capital to young, mostly loss-making companies. According to the latest data, it has 3,600 customers in Europe, around ten percent of them from Germany. HelloFresh (cooking boxes) and Lilium (air cabs) are among its German customers.

What about other banks?

The loss of value of bonds is not only a risk for Silicon Valley Bank. If the financial institutions need cash, they must sell these securities at a loss. Overall, U.S. banks hold more than $620 billion in unrealized losses in their portfolios. However, the big money houses are much more diversified, and insolvency remains unlikely there according to prominent economists.

The entire development is now weighing on sentiment - and not just on Wall Street. Shares in Deutsche Bank and Commerzbank lost more than 5% of their value on Friday.

The reasoning is clear: If SVB had a lot of treasuries on its balance sheet with an unrealized loss, other banks must have it, too. And indeed, let’s check some other banks and their current unrealized losses in securities (columns 5, 7, 9).

Found on Twitter: @CouchPotatoSJW on March 11, 2023

Why was it so important?

The FED is guaranteeing the depositor’s fund and prevents therefore an “extinction-level event,” as some startup leaders had warned. More than half of US tech and life sciences startups banked with SVB, and many were concerned they wouldn’t have enough money to pay employees this week or keep their companies running.

This is an *extinction level event* for startups and will set startups and innovation back by 10 years or more.

BIG TECH will not care about this. They have cash elsewhere.

All little startups, tomorrow's Google's and Facebooks, will be extinguished if we don't find a fix.— Garry Tan 陈嘉兴 (@garrytan) March 10, 2023

What will happen to SVB? Its assets will be sold to the highest bidder. The FDIC, which now controls SVB, began an auction for the bank’s assets Saturday night. The cleanest outcome would be a single buyer, but there are only a few banks big enough to realistically scoop it all up, such as JPMorgan, Citigroup, or Bank of America.

Bottom line: SVB will remain in the headlines for days and weeks to come. The meaning(lessness) of FDIC insurance and the regulation of mid-sized banks, as well as how to prevent another SVB-like collapse will start not only in the US but also in Europe.

Personal Takeaway: We all lived through a decade of capital excess

I lost more than 50% of my invested money in stocks between 2021 and mid of 2022. I took two learnings from this painful experience:

I joined the market at the peak of capital excess with 0% interest rates which is why I did not take a change in macroeconomics into consideration

I joined the FOMO investing in being greedy and looking for short-term gains

But what I am realizing more and more is that getting used to such a condition is not only something for the inexperienced but especially for the experienced with a big ego. If you believe that you know how things work, you will underestimate the risk management needed to make sure you are prepared for rainy days.

Risk Management is a strategic measure you need to take - in your personal and your work life - to make sure you don't "blow up" as Nassim Taleb (author of Black Swan).

What I read last week:

Netflix Is Dominating Sports Without Live Rights (Huddle Up)

Inside Uber’s move to the Cloud: Part 1 (The Pragmatic Engineer)